For the first time since July families are not expected to receive a 300. The latest on the enhanced child tax credit getting extended past 2022.

A federal income tax return the New York State child and dependent care credit is allowed only if you file a joint New York State tax return Form IT-100 IT-200 IT-201 or IT-203.

. FAMILIES have grown used to monthly 300 payments through the expanded child tax credit but in February 2022 theres a chance the long-awaited extension could double payments. An estimated 10 million children will. The legislation needs the votes to pass but with Congress on holiday and division among some democrats any vote looks likely come in 2022.

The child tax credit isnt going away. But without intervention from Congress the program will instead revert back to. 5 2022 500 am.

Child tax credits may be extended into 2022 as payments worth up to 900 could be sent out. Hold on to this notice --. The BBB plan extends the child tax credit from 3000 to 3600 per year and per child.

Recipients of the third round of the Economic Impact Payments will begin receiving information letters at the end of January. In January 2022 the IRS will send families that received child tax credit payments a letter with the total amount of money they got in 2021. Meanwhile the Internal Revenue Service IRS says it will need time to resume payments when the time comes.

How the child tax credit will look in 2022. The good news is. A significant piece of President Bidens domestic agenda has come to an end.

In case the legislation is not approved. If you will not be eligible to claim the Child Tax Credit on your 2021 return the one due in April of 2022 then you should go to the IRS website to opt out of receiving monthly payments using. The IRS sent the last child tax credit payment for 2021 on December 15 2021.

The monthly expansion of the existing child tax credit expired last month after Congress. Given the popularity of the program with millions of families theres a chance the credit could be extendedA recent study. COVID Tax Tip 2022-03 January 5 2022 The IRS started issuing information letters to advance child tax credit recipients in December.

How to claim the credit In addition to the above federal requirements to claim the New York State child and dependent care credit you must.

Taxtips Ca 2022 Non Refundable Personal Tax Credits Base Amounts

Build Back Better Salt Gains For The Rich Eclipse Child Credit Boost Committee For A Responsible Federal Budget

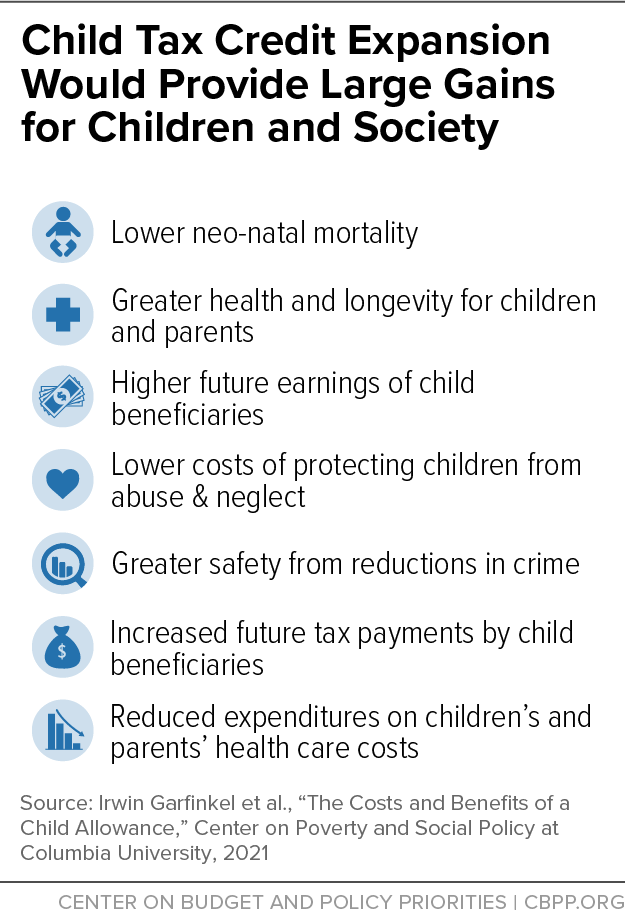

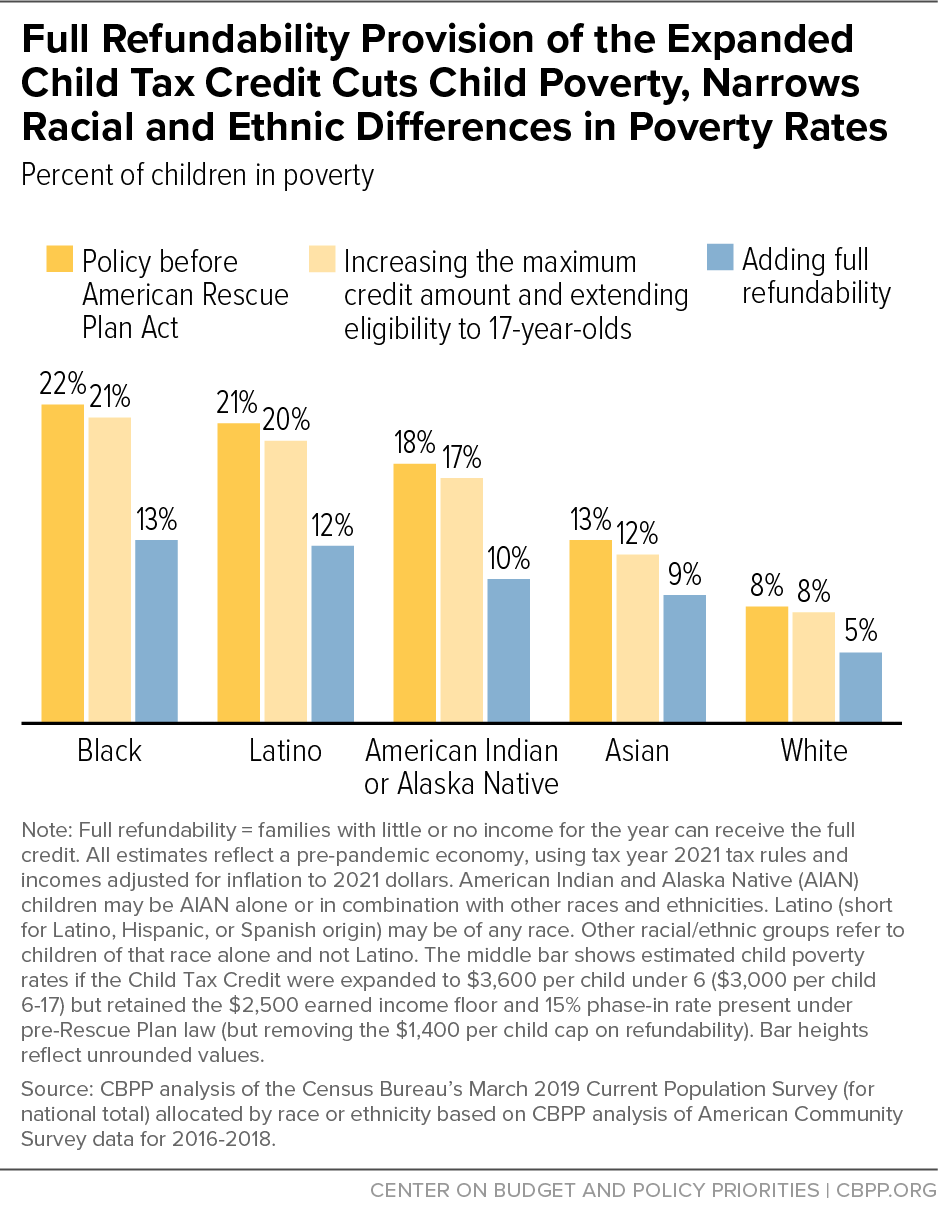

Build Back Better S Child Tax Credit Changes Would Protect Millions From Poverty Permanently Center On Budget And Policy Priorities

Will The Enhanced Child Tax Credit Continue In 2022 Here S Everything We Know Cnet

What You Need To Know About The Child Tax Credit Forbes Advisor

Five Facts About The New Advance Child Tax Credit

Build Back Better S Child Tax Credit Changes Would Protect Millions From Poverty Permanently Center On Budget And Policy Priorities

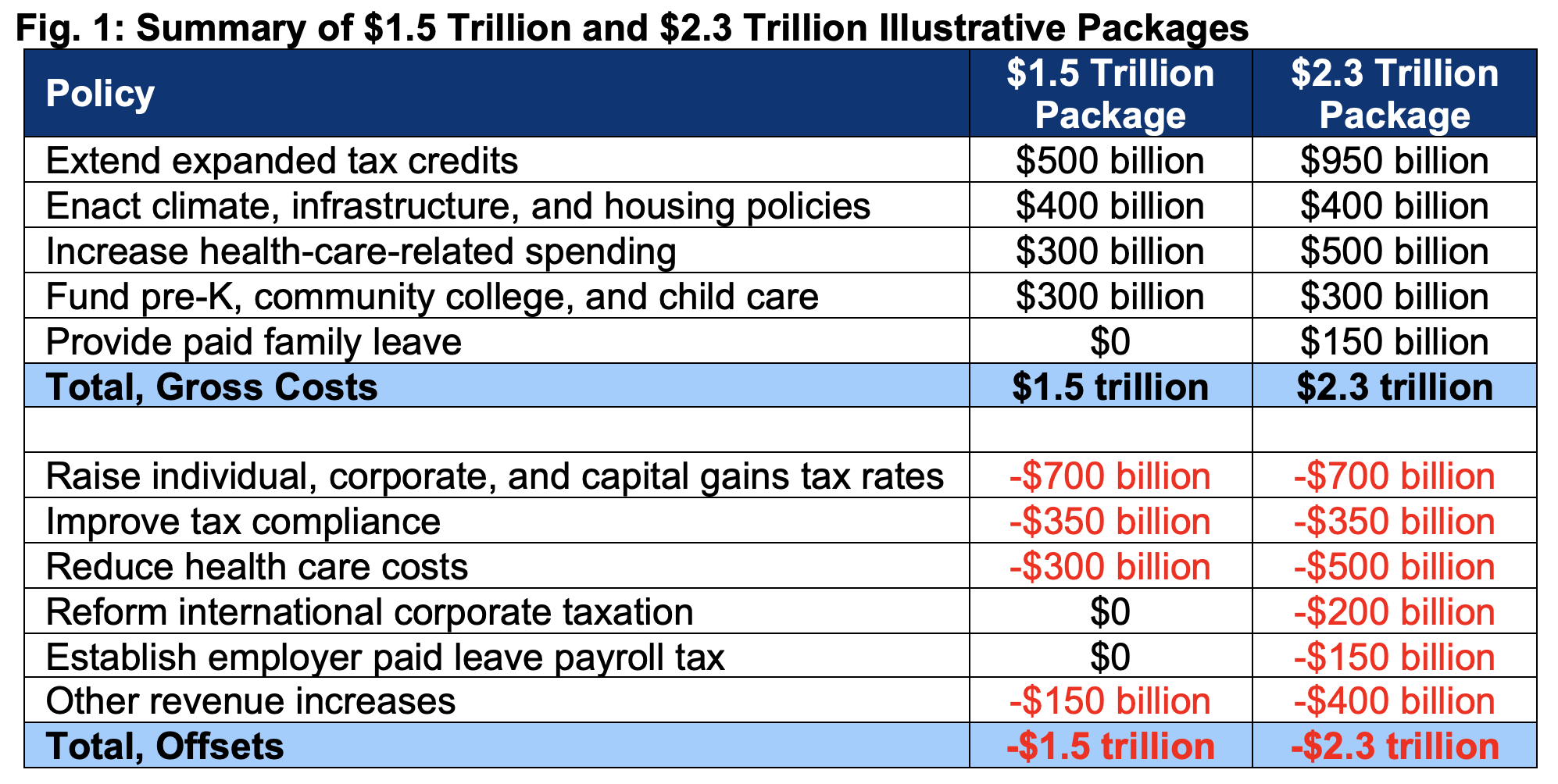

Build Back Better For Less Two Illustrative Packages Committee For A Responsible Federal Budget

Child Tax Credit Payments Are Over But You Could Still Get 1 800 In 2022 Cnet

Ontario Child Benefit 2022 A Guide To Ontario S Child Benefit Programs

Build Back Better S Child Tax Credit Changes Would Protect Millions From Poverty Permanently Center On Budget And Policy Priorities

The December Child Tax Credit Payment May Be The Last

Child Tax Credit How To Opt Out Of Monthly Payments For One Payout

Will Monthly Child Tax Credit Payments Continue In 2022 Kiplinger

Build Back Better S Child Tax Credit Changes Would Protect Millions From Poverty Permanently Center On Budget And Policy Priorities

/cloudfront-us-east-1.images.arcpublishing.com/gray/2QLO7BDGDZFJFBF7CRXICW4JX4.PNG)

Deadline To Apply For 2021 Child Tax Credit Is Monday

What To Know About The First Advance Child Tax Credit Payment

Child Tax Credit Payments Are Over But You Could Still Get 1 800 In 2022 Cnet

Child Tax Credit Update Families Will Get Paid 7 200 Per Child In 2022 By Irs Fingerlakes1 Com